Explaining The “Big, Beautiful Bill”

What’s in it, who does it benefit, and why one big bill?

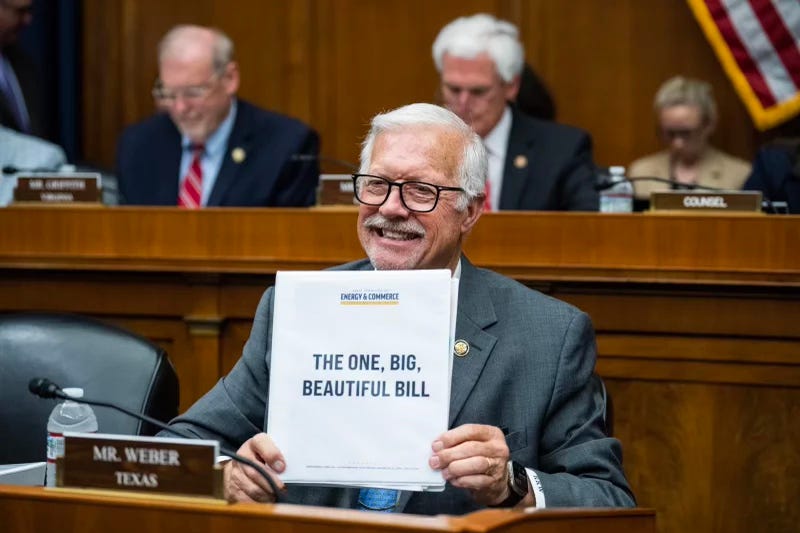

On May 19, the fine folks at the Associated Press reported that House Republicans in the Budget Committee have narrowly advanced Trump’s “Big, Beautiful Bill” during a rare Sunday evening vote. Shockingly, given that Republicans currently hold majorities in both Houses, the bill was passed with a NARROW margin - and it may still face an uphill battle in the House proper due to Republican infighting on what should go in the bill, what should leave the bill, and what needs to be MORE aggressive.

Frankly, it’s a bit of a clusterfuck - and Republicans are far from a united front, with Democrats finding unusual allies in people like Josh Hawley and House Freedom Caucus leader Chip Roy. The biggest issue, according to the Associated Press, is that “the bill’s new spending and the tax cuts are front-loaded in the bill, while the measures to offset the cost are back-loaded. In particular, they are looking to speed up the new work requirements that Republicans want to enact for able-bodied participants in Medicaid.”

But at this point, I’m sure you may be asking: what the hell is the “Big, Beautiful Bill?” What’s in it that’s spooking out key Republican votes? Is it something that’s likely to pass?

WHAT IS THE BIG, BEAUTIFUL BILL?

You’re not going to get a helpful answer to this question on the White House website on the BBB, at least not one that isn’t loaded with bias and unnecessary capitalization.

“It delivers PERMANENT tax cuts and bigger paychecks,” the White House stated. “This means an extra $5,000 in Americans’ pockets with a DOUBLE-DIGIT percent DECREASE to their tax bills. Americans earning between $30,000 and $80,000 will pay around 15% less in taxes. It includes NO TAX ON TIPS and NO TAX ON OVERTIME. This makes good on two of President Trump’s cornerstone campaign promises and benefits hardworking Americans where they need it the most — their paychecks. It provides historic tax relief to Social Security recipients. It slashes taxes on seniors’ Social Security benefits.”

Playing devil’s advocate for a second, this first point certainly SOUNDS good. We’ll wrap back around to its accuracy in a second, but even within the press release for this bill, the Trump administration can’t help but derail any good will by making absolutely baffling promises most Americans clearly wouldn’t want. “It protects Medicaid for Americans by removing 1.4 million illegals.” “It makes President Trump’s border security permanent…[by funding] President Trump’s border wall.” “It ends taxpayer-funded sex changes for minors…The One, Big, Beautiful Bill restores sanity to government.”

Amusingly, it also promises to “modernize” air traffic control, taking the opportunity to take a potshot at the Biden administration despite a number of plane crashes possibly caused by Trump’s gutting of the FAA.

So, what’s REALLY in the bill? Kevin Freking and Lisa Mascaro at Associated Press explain that this mess of a bill is 1,116 pages long, and the highlights include:

THE GOOD NEWS (and bad news) ABOUT TAX CUTS:

As expected, the BBB is top-loaded with tax cuts; not only for businesses, but individuals too. And truth be told, not all of these are that bad. The 2017 income tax cut Trump enacted back in 2017 would become permanent, and tips and overtime pay would now no longer be taxed. On top of that, interest would be removed situationally from certain auto loans., and there’s now a $500 increase in the child tax credit, with estate tax exemptions being raised to $15 million.

These cuts on their own would make for a perfectly serviceable bill that, in many ways, would be one of the best things the Trump administration has ever done. And yet, like any good deed gone unpunished in the Trump administration, you might be asking, what’s the rub? This article’s looking a lot longer than just this paragraph, Harry.

For starters, the word “permanent” is doing a lot of heavy lifting in the first paragraph here.

“Several of the provisions Trump touted on the campaign trail would be temporary, lasting roughly through his second term in office,” Freking and Mascaro write. “The tax breaks for tips, overtime and car loan interest expire at the end of 2028. That’s also the case for a $4,000 increase in the standard deduction for seniors.”

That means virtually every good thing about the bill is temporary at best and conveniently expires at the end of Trump’s final term in office - meaning whoever takes the office of the presidency next has a ridiculously expensive mess to clean up. But this is a minor issue compared to the absolute horror show of the remainder of the bill. Horror like:

CUTS TO SNAP:

Good news for absolutely nobody: if you’re facing food insecurity, you now need to be gainfully employed in order to eat, with Republicans in the house looking to make states pay for the Supplemental Nutrition and Assistance Program, or SNAP, themselves to the tune of five percent of the total benefit costs and 75% of the administrative costs. Curiously, this also starts in 2028 - almost as if Trump knows this is a horrible idea and wants the next President to suffer.

But that’s not all! The work requirements for food aid are being expanded as well. As Freking and Mascaro put it, “Under current law, able-bodied adults without dependents must fulfill work requirements until they are 54, and that would change under the bill to age 64. Also, some parents are currently exempt from work requirements until their children are 18; that would change so only those caring for a dependent child under the age of 7 are exempt.”

CUTS TO MEDICAID:

In one of the most highly publicized and controversial aspects of the BBB, the U.S. is now going to cut anywhere from $600 billion to $800 billion in spending on Medicaid.

“To be eligible for Medicaid, there would be new “community engagement requirements” of at least 80 hours per month of work, education or service for able-bodied adults without dependents,” Freking and Mascaro write. “The new requirement would not kick in until Jan. 1, 2029, after Trump leaves office. People would also have to verify their eligibility for the program twice a year, rather than just once.”

Interestingly, these cuts are a huge part of how the rest of the BBB will be funded. As Kevin Prokop says for Vox, 7 million people becoming uninsured overnight is the price Republicans are willing to pay for Trump to get his border wall (more about that later). Furthermore, he points out that the BBB “would punish states that use their own money to fund health coverage for unauthorized immigrants by cutting their federal Medicaid funds. (Fourteen mostly blue states and the District of Columbia currently fund coverage for children even if they are undocumented.)”

What makes this part of the bill extra disorienting is how it states, plain as day, that this funding is being cut specifically to target Planned Parenthood for its abortion services - even though abortions make up around 3 to 12 percent AT MOST of Planned Parenthood’s services. It’s also specifically allowing the Trump administration to remove tax-exempt status from non-profits it claims support terrorism, which is a dangerous, dangerous amount of power to put into the president’s hands.

SO MUCH MONEY FOR TRUMP’S BORDER AGENDA AND DEFENSE:

Good news for people who hate immigrants: the BBB is giving over $46 billion to restart construction on The Wall, as well as giving more money to Trump’s deportation saga, which includes:

$4 Billion for 3,000 more Border Patrol agents and 5,000 more customs officers

$2.1 billion for any “signing and retention bonuses”

An undisclosed amount for 10,000 more Immigration and Customs Enforcement officers and investigators

Any migrants seeking asylum need to pay $1,000, which is something the U.S. has never done. Grimly, Freking and Mascaro end the passage by stating, “Overall, the plan is to remove 1 million immigrants annually and house 100,000 people in detention centers.”

This is nothing compared to the money being granted to the Department of Defense: $150 billion, $25 billion of which will go to Trump’s Simpsons-ripoff “Golden Dome for America” project. The remaining balance will go to restocking America’s ammo arsenal ($21 billion), expanding the naval fleet’s ships ($34 billion), and - of course - raising security at the border (an additional $5 billion).

THE REST OF THE BILL IS JUST AS BAD:

We’re talking a complete re-imagining of the student loan program: $330 billion in cuts, but the program has now been simplified into two repayment plans: a standard option with monthly payments spread out 10 to 25 years, as well as a “repayment assistance” plan with vague language that Freking and Mascaro describe as “less generous.” Plus: did a college defraud you or shut down? Biden made it easier to get loans for those schools canceled; Trump made it nearly impossible in the BBB.

In case all of this isn’t sounding cheap enough, don’t worry: revenue is going to be generated through public land leasing for drilling, mining, and logging. Biden’s fossil fuel curbing, which was intended to address climate change, is being repealed. Oh, and hundreds of thousands of acres of land in Nevada and Utah are being sold, too. God bless America. We’re also seeing a $200 tax on gun silencers get removed, for some reason, which has been a thing since 1934. Which is… a thing.

SO. Other than the medicaid cuts, how are we paying for this? According to Kevin Prokop at Vox, we uh… won’t.

“The vast majority of it will be unpaid for and just increase the debt, while other costs will be hidden with gimmicks,” he writes. “But the House GOP has proposed paying for some with deep cuts to Medicaid, clean energy, student loans, and food stamps, among other areas.”

This is actually where the controversy surrounding the bill begins to arise with Republicans. Some think the cuts aren’t aggressive enough, and others dislike certain things being cut. Still, we’re looking at $600 billion in clean energy cuts created by the Biden admin, on top of the $300 billion in student loan cuts, $300 billion in Food stamp cuts and $600 billion in Medicaid cuts - with almost all of the changes proposed simply adding to the national deficit.

As Prokop puts it, though:

“The problem is that it isn’t 2017 anymore — and blowing up the deficit could hurt a whole lot more. Many of these cuts are controversial, even among some Republicans, and it’s unclear which will make it into the final version of the bill. But currently, House GOP fiscal hawks are saying all this isn’t enough, and they’re demanding even steeper cuts, saying it would be completely irresponsible to add so much to the deficit otherwise.

While many of the cuts they’re proposing would target the most vulnerable and seem cruel, they have a point about the deficit. Trump and GOP leaders are proceeding as if conditions are similar to 2017 — a time when interest rates were low, inflation was low, and Trump could pass a big deficit-increasing tax cut bill with few negative economic consequences. And indeed, both parties have tuned out warnings about the deficit and debt for years.

But conditions have changed. The US just went through a period of its highest inflation in decades. Interest rates remain high, in an attempt to prevent such inflation from roaring back. US Treasury bond rates are also high, which many interpret as signaling investors are concerned about the budget deficit. Years of big spending are adding up, and interest payments on the debt are rising.

All that is to say that a big budget-busting bill could be much more damaging to the economy than it was in 2017. And yet Republicans appear to be going full steam ahead anyway. It remains to be seen whether they can actually come to an agreement and pass a bill — but even if they do pull it off, they should be wary of getting what they wish for.”

Donald Trump’s “Big, Beautiful Bill” might be indeed big, but it’s actually one of the ugliest affronts on the most vulnerable among us and legitimizes most of his worst tendencies as a wannabe tyrant. It helps corporations, first and foremost, and damns the country into a much worse place than it already is by the time he leaves office. If this bill passes, this could actually be the tipping point for Trump - and worse, since the worst of it will not be seen till he leaves office, he may not face any consequences for it at all.

Thank you for breaking the “BIG, BEAUTIFUL BILL” down. Typical Trump went into the Capital this morning acting again like a mob boss. It will be interesting to see if the N.Y. Republicans Representatives buckle.